The failure of the modern economy

Table of Contents

Who are we, where did we come from, and most importantly, why was Bitcoin born and what is its socioeconomic purpose?

The priory is benevolent.

This article is based on Giacomo Zucco’s talk for BitGeneration done at the Polytechnic University of Turin. BitGeneration is the first project in Europe to introduce Bitcoin to high school students. Those who would like to view it (in Italian):

As additional in-depth sources to go along with this article:

- Shelling Out: The Origins of Money by Nick Szabo;

- Bitcoin Is Digital Scarcity by dergigi.

If you would like to support my work, you can visit the donation page. Every contribution, whether large or small, helps me spend more time writing, revising, and updating these articles. Thank you for your support!

Syllabus #

Bitcoin has existed since 2008. There is blockchain, cryptography, and other technical aspects, but what is the purpose of Bitcoin from a social and economic point of view? I think few people have actually asked themselves this question.

Preface: what I will describe will be a kind of pseudo-history of money, we will start from the basics, build what is needed to approach the concept of money, and finally analyze which features of money are negated by the modern tool we call fiat money and which are restored by Bitcoin.

This representation will include economic, political and social theses. At the end of this psuedostory we will make a comparison between a world governed by the Bitcoin Standard versus the Fiat Standard.

Store of value #

Assumption: fiat money (born by decree) is not a good savings instrument. Everyone, at least once in their life, will have heard the advice not to keep a certain amount of money because it depreciates quickly and that investment would be the only way to protect one’s purchasing power.

In today’s day and age, money is an instrument that does not hold value but rather slowly and predictably destroys it if we are talking about the euro or U.S. dollar, much more dramatically with the local currencies of Turkey, Venezuela or Ukraine. The issue is very sensitive for most currencies in the world, which have already had numerous hyperinflationary events, and it applies (although in a slightly different way) to strong currencies such as the dollar or euro. The dollar, although it has not been the victim of any particular hyperinflationary phenomena, has lost more than 90% purchasing power in the course of its existence.

Crusoe Economics #

We start with a simplified model that is called by economists the Robinson Crusoe model.

Robinson is a castaway who has survived a very bad marine accident, wakes up on an island in the middle of the Pacific Ocean but is alone, cannot interact with anyone, and has to start making economic decisions such as:

- Lying on the beach because he is tired from the shipwreck;

- Getting up and looking for food, shade and water.

A week has passed and Robinson has recovered from the shipwreck, he gets up in the morning and goes fishing bare-handed for wild fish in the bay off the island, which he promptly cooks over the fire and feeds himself, day after day. It goes on like this for a long time. Every day he captures a fish and consumes it.

This life is bearable, perhaps a little monotonous, although when something new happens something much more serious might happen: Robinson falls ill in the throes of tropical fevers on Thursday and therefore cannot fish. On Friday he comes back strong, catches two fish, consumes as many to get his strength back, Saturday proceeds as usual but on Sunday and Monday a tropical storm hits, preventing him from fishing. Result? Robinson dies and there is no economic development.

Savings #

There are alternatives to this miserable life, and our Robinson knows it. If it were possible to stay twice as long in the water by being able to catch two fish rather than one (and resting a little less in the cave), Rob could catch two but eat only one, effectively creating a savings, which grows over time.

At this point when a crisis comes Robinson has only to wipe out some of the savings he has obtained, consume some of the fish set aside, and that preventive action of saving made earlier will allow him to survive. All this provided that the fever or tropical storm does not arrive in the first days of his life on the island disrupting his future for sure.

Innovation #

Another thing Rob realizes he can do is to voluntarily give up -on certain set days- fishing to spend his time on other activities, such as working in the cave to create a spear with a wooden stick and a sharp flint. With this spear he is able to increase the productivity of his fishing activity because he can now catch four fish a day, spending even less time. This technological growth allows him exponentially greater savings when compared to fishing with his bare hands.

Greater savings, greater time to evolve is therefore our Rob goes from spear to fishing pole, from fishing pole to net fishing boat, and from net fishing boat to Captain Findus’ nuclear fishing boat with gamma ray missiles to hit whales.

Problem: Permanence of Wants #

After Robinson learns to keep some resources away to use them up in future, our islander has more free time and more acquired technology here comes a problem, that of permanence of wants. Rob knows that he has to save something but does not know exactly what. He could focus on fish, coconuts, sea sand and so on; there are many useful resources but he has to choose what to focus his attention on. The future is unpredictable and Rob needs to reduce this unpredictability.

How can he do that?

A first solution is diversification, saving a little bit of everything, but it is not efficient because he will not become good at conserving anything by dispersing his talents as a consevator in so many different things. Rob needs to focus on some particular kinds of goods; in history (I simplify, but it was not so rapid) goods naturally emerged that had two characteristics (but there are others as well) on which people began to converge: physical durability and scarcity.

Fish, used as an initial example, definitely does not have the characteristic of durability over time as it is easily perishable; sand is very physically storable because its characteristics remain unchanged over time but on the other hand it is definitely not a good idea to store sand because it is present in abundance on the island and is not a scarce good. A scarcer asset with the same use value is worth more to deal with the uncertainty of the future.

..but why?

Because if Rob needed sand he could simply go to the beach on the island and collect some. There is no limit to the demand of sand and therefore any future supply of sand would certainly be met. Consider instead some very rare shells with which Rob wants to decorate his cave; unlike sand (which is more useful engineering-wise) they are only an aesthetic quirk and of these rare shells on the entire island there are only 21; what Rob knows is that whatever the demand for these shells, the supply can never grow since they represent a naturally scarce commodity on the island.

Scarcity is measured with a metric called stock-to-flow, such as how many shells Robinson has (stock) versus how much he can produce (flow) in a unit of time. The S2F is a measure of time:

\(S2F = \dfrac{quantità}{\dfrac{quantity}{day}}= \dfrac{1}{\dfrac{1}{day}}= day\)

In the case of shells, the S2F is \(\infty\) because the numerator has how many shells Rob owns (21) and the denominator has how many he can produce (0).

Medium of exchange #

We begin to have Rob interact with other agents in the system such as a tribe of cannibals. Rob fights this tribe is frees a good cannibal who becomes his friend, whom we will call Bill. Rob and Bill share tasks, Bill is very good at hunting, Robinson has superior technological notions.

The interesting thing is that already in this first model of interaction we see what the sociologist Oppenheimer called economic means versus political means. Economic means are those in which multiple people can satisfy each other by freely exchanging, political means on the contrary exploit violence to obtain a good and are based on power relations.

Sharing #

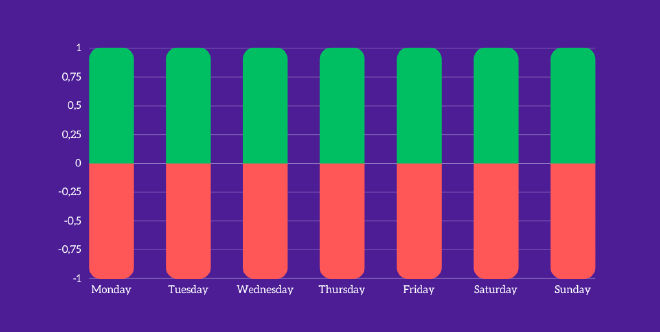

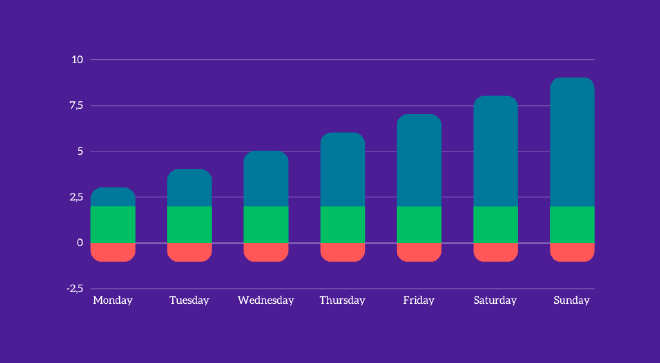

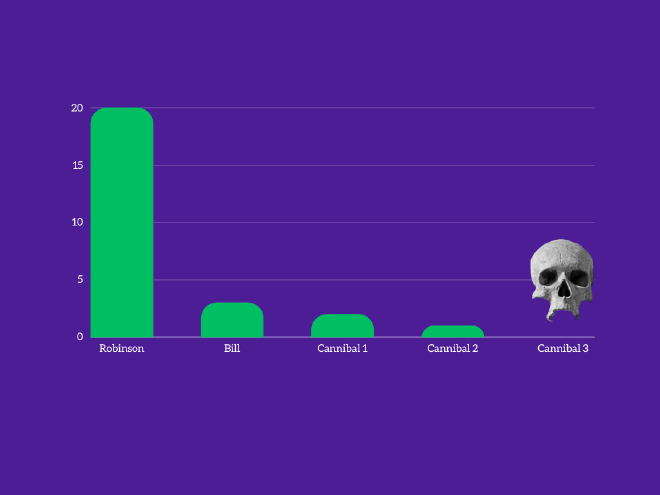

Gradually more and more cannibals join Rob and Bill, and if we imagine that on the x-axis (bottom graph) we fit the people on the island rather than the days of the week, we notice that Rob is great at fishing because he has superior notions and technologies, Bill uses the spear, and the other cannibals fish either with their hands or do not know how to fish.

As in the first graph about Rob alone, where as time increased Rob was able to catch and consume only one fish each day, here as the quantity of people increases, the economic value of each does not increase. The overall economic return of the group, adding up the utilities (the fish) of everyone and dividing by the number of people, does not increase the productivity of the group. Just as Robinson alone discovered savings, similarly these other agents discover the utility of sharing.

If, for example, Rob catches 20 fish, he can give two to Cannibal 2, who still fishes with his hands, and this action actually looks like pure altruism; in history, pure altruistic exchanges exist but generally do not scale well beyond fairly small, homogeneous groups with a high rate of trust.

If I tried to reconstruct the graph 20 times by inserting different specializations for different inhabitants of this small tribe, what we might notice is that the “high” column might not always be on Robinson. If another specialization is hunting, Bill is unbeatable and therefore we can say that the “high” column shifts among the members of the population based on the specialization we are considering.

- Cannibal 1 is a formidable well digger;

- Cannibal 2 builds piles impeccably;

- Cannibal 3 cooks like a star chef.

The usefulness of this group grows with the addition of new people who are specialized and live in harmony. The division of labor becomes one of the cornerstones of human civility.

Problem: Coincidence of Wants. #

In addition to the already addressed problem of permanence of wants, there is another problem called coincidence of wants. What an individual possesses is not always needed by someone else.

Robinson has plenty of fish but is thirsty, he meets cannibal 4 whom he asks to exchange fish for water, but cannibal 1 says he has only boar. But Rob needs water, not boars! Rob then turns to cannibal 1 (the well digger) who, however, does not want fish but boars.

They would have to arrange a rotational exchange, which is complex to execute.

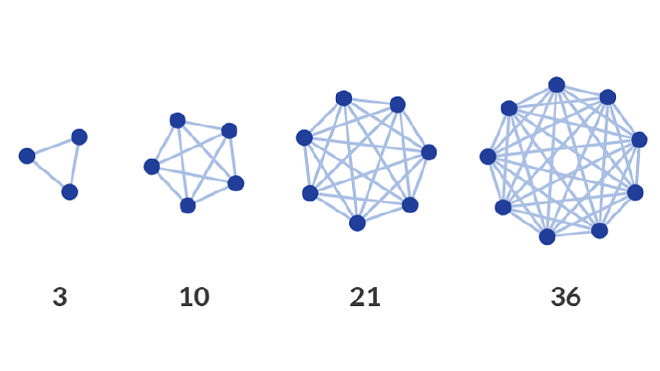

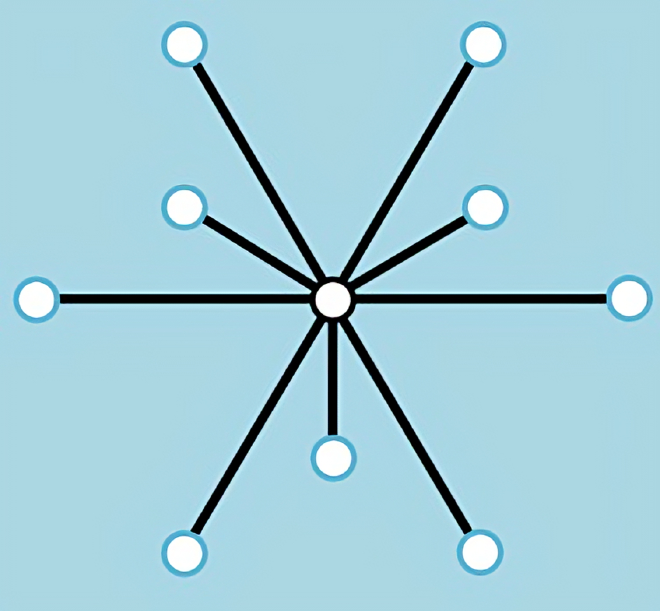

The number of possible exchanges between agents grows as the number of agents increases as ~\(n^2\) where \(n\) is the number of participating nodes. It is the law of decentralized networks.

This law makes direct exchange between many specialized nodes inefficient. In small groups it is solved by the invention of credit (I owe you a favor) but again, it does not scale to large groups. Barter is not an efficient tool for building a civilization; one can at best create a tribe.

In contrast, the law of centralized networks dictates the centrality of a figure connected to all nodes. This solution scales better because the central manager acts as a hub of exchange between two nodes connected to him. The exchange does not take place directly (peer-to-peer) but goes through a central node.

The key thing is that the central handler is not a person, but is an asset or service recognized and exchanged by everyone.

Here it would no longer be necessary to exchange fish for water, but it would be enough to exchange fish for this central asset (x) because in turn this asset will be used a later exchange. The possibility of exchange becomes manageable because it grows as the number of nodes increases and the entire population converges on this object that acts as an exchange protocol for everyone.

One cannot predict with certainty what the chosen medium of exchange will be, but there tend to be two criteria taken into consideration.

Social Scalability #

The idea of social scalability is based on the fact that just as in order to have a savings instrument one must choose those assets that resist the most wear and tear of time, in the same way in order to exchange I must have an asset that if adopted by many people is not worse, it must therefore be socially scalable. There must be no constraint on the adoption of this currency; to make everyone adhere to a single standard one of the criteria for social scalability is the concept of neutrality.

Unless there is a very clear power relationship (a dominant imposing its own standard) the most normal thing is to use a standard that is not tied to a specific individual, because otherwise that individual gains too much power. In the island example, it is as if the standard of exchange became fresh water, and therefore Cannibal 1, who is a well expert, had a position of privilege over the chosen standard.

Privacy #

In the history of currency, almost all goods used as objects of exchange tended not to have a connection to the person who had previously held it.

Example: a newsagent sells hundreds of newspapers a day to people who simply leave a coin, take the newspaper, and leave. The newsagent cannot afford for this kind of exchange to know who those people are, what their political views are, how wealthy they are, and how much ability they have to repay a credit; that is why the newsagent cannot accept favors, because it is not scalable, but must interact with so many people that the important thing is that they know who the newsagent is, but the newsagent does not need to know the customers otherwise the business could not scale.

The medium of exchange should be a separate and segregated object from the identity of the people. Money should be independent of the user, and good money is money that allows the user to guarantee its confidentiality.

Virtual Money #

Commodity. #

We often hear people refer to Bitcoin as the virtual money but in fact it is the exact opposite. We are in a world of currency that is already virtual, and Bitcoin is an attempt to devirtualize currency itself.

Let us start with the concept of commodity, the gold nugget. Over time on Robinson Island we have chosen gold as a store of value and medium of exchange, because it is quite divisible but it is very compact, it is easy to hide and it does not carry someone’s “political history” and also it is a scarce commodity: gold exists on the island in a certain amount of tons, if its value increases the gold producer cannot double production. But even if production could double gold is interesting because about 1 percent of the existing gold is produced each year. More is produced each year but the growth has always been in the 1% to 3% range. The stock-to-flow is very high and is one of the reasons why gold has become a precious metal used as currency.

Coinage #

But gold has a very important verification cost, if I wanted to buy an apartment from you who are reading this, you would want to be sure that mine is actual gold and not a mixture of alloys that contains -for example- also tungsten. This problem is the problem of recognizability and is closely related to scarcity: what is the difference between a pure gold token and an alloy that also contains gold?

The difference is that with the same amount of gold I can create many impure tokens and thus I can increase the supply by decreasing its relative purchasing power.

Into this discussion comes the concept of coinage. We start with the term coinage, which comes from the temple of Juno Moneta (the Roman version of Hera) and in this temple offerings were made; Juno liked gold very much and the priests of this temple had a lot of gold in their hands that they had to spend. To do this, they set up a small foundry near the temple and began to melt it down into fixed units with set weight. At some point this process became so efficient that everyone around the temple rather than exchange a chalice or nugget of gold began to exchange a defined amount by the priests of Juno Moneta’s temple.

The money was not a monopoly of jewelers or priests, it was simply gold that everyone could use without any problems..but if you used the minted vesion the merchants made a small discount simply because it was much easier to verify. There was no money governor, it never existed (except for a few very brief episodes) until the second half of the 1800s.

So money had emerged naturally from society and there were only the coiners who in competition with each other put a kind of signature, a printed effigy, which was easy to verify but complex to reproduce. Coinage becomes a great enabler of exchange. The problem is centralization provides great power to the coiners: if people trust the coiner and trust the effigy exclusively, the coiners might start thinking about putting 90% gold and 10% of some cheaper alloy, that way people continue to exchange quietly while the coiner saves considerably.

Seigniorage #

Seigniorage (conspiracy theories removed) is a term for the difference in value between the amount of gold inside and the nominal sale of an object.

Let’s say I have gold cups and I want to use them to spend currency: I have to mint them. I go to the priests, give the gold cups, and they give me coins back….

…but do they do this work for free?

Of course they don’t! There are two business models:

- I give the priests 100 grams of gold, they give me back 99 1-gram coins and keep 1 gram for the work done;

- I give the priests 100 grams of gold but they perform the minting for free: they don’t return 99 1-gram coins, but they return 100 1-gram coins but with 99% gold inside.

The second business model dictates that I have and must disseminate in the marketplace 100 1-gram coins that are, however, worth a little less than what is written on each one, because there is only the the 99% of gold. Sooner or later someone will notice, there will be more of these coins in the economy than there should be for the same gold content, and that’s when the value of these seigniorage-making temple coins is priced less.

On reflection this is the beginning of a virtualization of money because in the case of the nugget the only value that was exchanged was the value contained in the nugget itself, in the case of the coin the exchange value is no longer in the first instance the gold content but the value is the information on it conveyed by the trust in the entity that imprinted this information.

If there is a coin that says 1 gram, its value begins to be virtualized because someone I trust says this is 1 gram.

Custody #

What we have just seen is a first step of coin virtualization, and the second step is even more extreme because we realize that moving gold coins is heavy; pilgrims, with 20 horses and 10 chests of gold must travel to the Holy Land but to do so they pass through France, leave all their belongings with the Templars, and get a paper signed by the Templars that says verbatim, “this paper is equivalent to 20 horses and 10 chests of gold.” At this point the pilgrims can go to the Holy Land guarding the slip of paper and give it back to the Templars who can return all the possessions that the pilgrims previously owned.

This is a further virtualization because there is no longer the exchange of either the nugget or the minted coin, but there is foil with no intrinsic value with the promise that a certain trusted party, upon presentation of this foil, will return our goods.

Fractional Reserve #

Another business model as ingenious as seigniorage takes the name of fractional reserve. The concept is this: a generic banker asks pilgrims in the holy land -loads of possessions- for gold in exchange for slips of paper with a face value written on them that is supposed to represent the countervalue in gold. The banker ascquires this now, but will he keep it in the safe? No, he lends it out of interest to someone else and when that interest returns to his coffers he shares some with the pilgrim from the holy land who gave him the gold. In this way the typical banker who makes whole reserve says, “I keep your money, but you pay me the deposit fee!”, the one who fractional reserve says, “you give me the money, I keep it and give you a slip of paper with the promise of conversion but not only do you not have to pay me, I pay you!”.

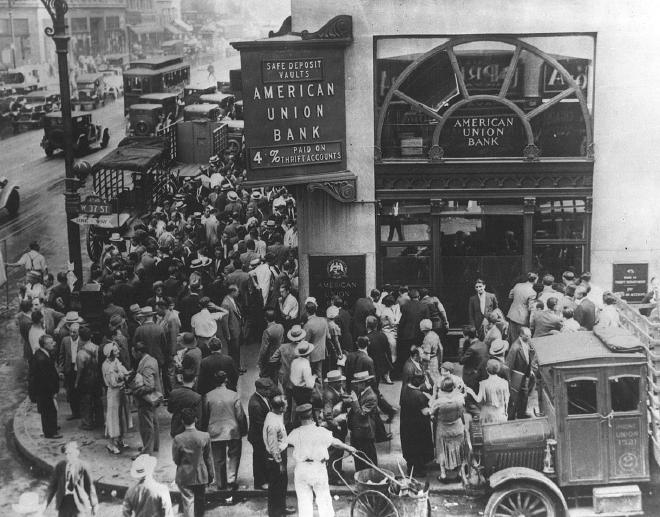

This is not necessarily a bad model, but it becomes an incentive for the dishonest to start obfuscating the business model because this service “will be paid for” by the bank’s customers the day there is a bankrun and everyone runs to the counter to withdraw at the same time.

If you own a checking account that doesn’t charge anything for depositing, you will know that your money has been lent out, and if everyone came back for it at the same time they wouldn’t be there not because the bank has failed, but because that’s what it does for a living, lend it out to others.

Digitalization #

Let’s look at the progression we’ve had so far:

The next step is total digitization in central listings. 97% of the economic mass in dollars is not in physical banknotes, but in data on computers. Money is completely virtualized both relative to content and location; the fundamental difference with paper money is that even if paper money is waste paper because the central authority decides the value, at least it is physically in my possession, it is a bearer instrument.

With digitized central records we no longer have a physical bearer object, but we have a list with my name and surname on it that says how much I own. This list makes the cost of censorship or confiscation extremely low.

Legal tender #

Many define as currency only that which is imposed by a state as currency, the legal tender. In general it means that there is a legislative framework that in various ways if not compels you at least pushes you in a major way to use the national currency instead of other alternatives.

The first example of a legal tender might be a monopoly, prohibiting other producers from performing a certain function, or a more extreme example is the petrodollar, the international agreement whereby if someone sells oil in some other currency that is not dollars, they get bombed. 🙂

Competition #

The starting point is competition, to give an example in the case of gold mining anyone can mine gold and anyone can trade it..but even in the practice of minting there has always been competition: the temple of Juno Moneta was in competition with a jeweler, who in turn was in competition with a prince and so on, gold was always gold even if it had a different effigy. But again, we have also had for centuries competition in custody in the issuance of convertible securities; the Templars issued their own piece of paper convertible into gold, but they were not the only ones performing this practice.

Monopoly #

A first step of monopolization was seen in mining, for example: a prince who decrees that in a certain area no one can mine gold because the land is his property and only the royal mining company can access the resources is a form of legal monopolization over gold mining.

A second element is the legal monopolization of coinage that occurred initially in the late Roman Empire when, after a huge phenomenon of debasement of the gold content you have the first cases of imposition of a monopoly of production; it happened later in China, Charlemagne, Frederick II also tried to do it. The idea was to prevent, in a certain area, from doing the work of the coiner unless directly controlled by the political power, which takes unequivocal control of the power to bestow this right.

If there are competing moneylenders and a couple of them go too far with seigniorage by debasing the currency too much, this causes disorder in the market, so political power takes matters into its own hands.

This “order and balance” in the hands of political power tends toward efficiency in the short run but creates incentives that tend toward inefficiency and worse outcomes in the long run. In human history there has never been a case of the debasement of money as important as in the case of state minting. While it is true that political power tends toward order and equilibrium, it is also true that seigniorage is a continuous but low-intensity disturbance, because moneylenders who apply seigniorage too extensively tend to suffer the consequences after an economic realignment. Their supply is not beneficial to the market, which consequently self-regulates by pricing their coins less.

The question that arises is, why does monopoly tend toward inefficiency in the long run? Trivially, as a matter of incentives.

high rates of quality is competitive prices disappear and this reduces the tendency toward efficiency and honesty. There is no competition, so why should they maintain a high standard at cheap prices?Price Control #

Monopoly generally has another feature which is price control; to counterbalance a monopolistic imposition of coins minted by a political force that have a very low purchasing value for the population, the market prices this currency low and price inflation is created.

This effect makes people angry because walking around with wheelbarrows of coins because they possess less purchasing power is not fun and especially because it is an imposition. Maybe someone would have liked to use another currency, but could not because of the monopoly effect. Today these laws are more nuanced, but they are still there.

Confiscation #

There is not only price control, but there is also the issue of confiscation, and I invite you to read the paragraph 1930 to 1940 of my first article on Bitcoin.

Bailouts #

Bailouts are that system in which a type of protected merchant (by political power) that goes under, is bailed out by the state coffers. It must be said that this maneuver can work as an emergency buffering system, but the problem always remains incentives.

Suppose we have two businesses A and B, the A business is very profitable, produces a lot of taxable income and will give this part of taxable income to the state. The B business, on the other hand, which is not sustainable and goes into crisis, will go to the state and ask for an emergency bailout; the state takes from A to give to B. But after a while this maneuver works.

- What is the incentive for those doing the A activity? None, because if it goes well he continues to be taxed, if it goes bad he loses the business;

- What is the incentive for those doing the B activity? If it goes well he earns and keeps the rest, if it goes bad others pay (A).

This concept is called moral hazard and is the problem why now the rate of investment in exotic securities comparable to the 2008 subprime of American banks is higher than in 2007. The absurd phenomenon with bailouts is that those who offer higher interest rates have a higher chance of bankruptcy, but even when bankruptcy comes, you are bailed out by the state.

Now it is no longer surprising to learn that the fractional reserve in many banks is 0% huh? 😁

Surveillance #

To implement price control policies, it is necessary to know who sells what and who sells how; if I want to bail out banks with state money, I must first take that money, for example, by taxing businesses that have been running. So the state needs to know who makes money, because it needs to know how and where to tax.

All the interventions analyzed above give rise to financial surveillance; political power has the greatest incentive, interest and need to police all exchanges and this becomes very easy with the total virtualization of currency. This kind of surveillance is the most obvious feature of the modern monetary system.

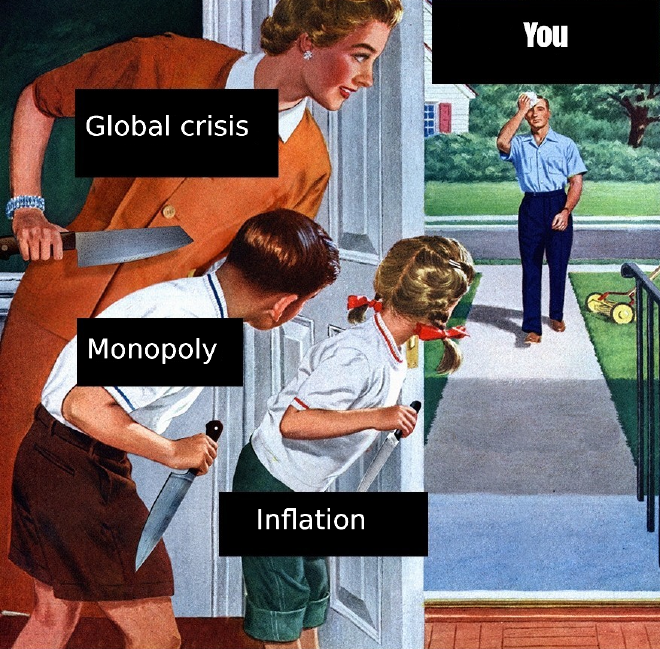

Fiat Standard #

Inflation is an inevitable trend because money is totally virtual, there is no cost of production, there is no cost of holding the countervalue in gold, but even there is not even the cost of printing the cash slips of paper. When people say Bitcoin is virtual it is pretty ridiculous because it is fiat currency that can be produced virtually without any cost; inflation generally is sold as a nice thing, but it is only nice for those who are debtors because the debt incurred is worth less and less and it is easier to repay it, less nice for those who are creditors. It’s a nice thing for exporters because it’s like momentarily drugging export capacity, less nice for importers.

Cantillon Tax #

In general, inflation is beautiful only for those who are close to the magic printer of money. The effect that governs this sentence is the Cantillon effect: Our dear old Robinson starts printing money in the basement of his house. He spends these bills. Rob is richer, but who is poorer? Has wealth been created out of thin air? If everyone did this little game it would radically change the balance of supply and demand for the various services that Rob will buy. So for the Cantillon effect I am not creating wealth, but I am shifting it wealth from the last ones to receive this money to the first ones to receive it, as if it were a wave that propagates from the ones who printed and comes to touch the last ones, and there is already a phase of the wave where people have lost more through inflation than they have gained from this money printed in the basement.

Modern states are almost all huge debtors, and as we have said the Cantillon effect privileges the debtor over the creditor, so there is an additional incentive on the part of states in exploiting this effect, because the debt depreciates faster and so I have to pay back less to savers who perhaps bought..um, government bonds?

A final piece of evidence of the Cantillon effect is fiscal drugs. All modern states have taxation that works in brackets and for which if, for example, someone earns more than 100k euros, they pay something extra. By printing more money the prices go up, we are in the same of situation as before but the 100k is worth less. So if an entrepreneur used to earn 50k euros, now he earns 100k but prices have doubled as well. So he lives exactly the same way he goes into the next tax bracket (unless the tax brackets are lowered but..strangely no nation state has ever done that)!

Business Cycle #

The business cycle is a situation whereby even if printing money does not immediately create inflation, it creates a distorted incentive to invest and bad investment.

If we return once again to Rob’s island, now largely evolved, he uses water as his favorite store of value. Everyone can have a cistern of water, every day you go to the river to fill a bucket with water and then return to the village. We adopt Robinson’s technique: we consume less water than what we have in the cisterns so that we can save some water and when there is 1 day’s coverage of water rather than going to the river we start digging a piece of canal; once 10 days of cistern is covered the islanders will have 10 days to dig a canal that brings water directly to the village and from then on there will be immediate water. Decentralization as we have seen is inefficient, while centralization is fragile but efficient.

So in the centralized case we will have the mayor of this village who will have his giant central cistern and only he can look into it. By overlooking his cistern he tells all the islanders how many days of water they can survive without going to the well (it becomes for all intents and purposes a measure of how much saving there is in the village). After a few generations, the mayor might think that if he gives the wrong message to the people by saying that there are 10 days of water available when in fact there are only two, for two days unprecedented economic vibrancy is created. After two days, however, the water doesn’t come and those who last the longest will run to the river, while a quarter of the population will die of thirst..but the mayor had to “last a short time” anyway, so he will leave the hot potato to the next mayor.

This metaphor is about the same as a modern-day measure called the interest rate; the amount of money issued by central banks conveys information about how much savings exists in society: a society that has a lot of savings will tend to have very low interest rates and vice versa; money printing manipulates these rates, cuts rates, and creates a rush-to-invest effect. One is enticed not to have money in cash because it would be eroded by inflation and better yet would be to spend it all and run up debt. This creates the incentive to create bad investments, the so-called modern market cycle.

Surveillance #

In addition to the political censorship we discussed earlier there is also another side effect which is financial exclusion. With complete political control every payment must be associated with a first and last name identity. This recognition process has a cost and not every human being on earth has enough savings or business income to justify this cost. Thus the absolute majority of people on planet earth are excluded from the banking and financial system and are underbanked or unbanked. In practical terms not having access to banking systems means not having access to e-commerce and more generally to online payments.

Finally, there is also an additional aspect: by opening a regular checking account you end up on a list that says who you are, what your name is, where you live, and exactly how much money you have. This list usually stays internally at the bank but very often this list is shared not only by the bank’s customers but also by employees of tax agencies and risk analysis agencies; generally we can say that there is a high risk of this list ending up in the secondary market of personal information on the Internet. When an attacker has to decide who to rob, without financial information it is difficult, but with that famous list it is much easier to threaten, make phising attempts or generally steal.

Result? Half the world has no access to financial services, the other half has a much higher rate of possible malicious attacks.

Bitcoin Standard #

The Bitcoin standard is in opposition to the fiat standard in the sense that in the face of inflation it aims to return to an idea of scarcity, where it is not political power that decrees how much gold is issued but are inviolable natural limits. The other aspect is a strongly focused issue at the privacy discourse: money must return to bearer status.

It’s not all doom and gloom of course, there are pros and cons because while there is a great increase in transactional freedom, financial inclusion, political freedom and less possibility of censorship, more private money subjected to less oversight will surely allow for paying political dissidents, funding war crimes or protesting against power.

To conclude, the temporary benefits generated by inflation, would no longer be possible with standard Bitcoin. If a bank fails, it fails and that would mean unemployed employees or current account holders losing money; the idea is that this creates an incentive in the long run to be more fair leading to fewer failures, because being bailed out with other people’s money creates an incentive system to fail because you have your back covered.

Cultural Roots #

Austrian:

- Scarcity;

- Saving;

- Durability.

Cypherpunk:

- Privacy;

- Sharing;

- Scalability.

Stay humble & stack sats.